Are you looking to skyrocket your fintech company’s growth and attract more qualified prospects to your business? The rapidly evolving fintech industry demands equally innovative marketing approaches to stand out in an increasingly competitive landscape.

As we navigate through 2025, financial technology marketing has transformed dramatically, with new platforms, technologies, and consumer behaviors reshaping how finance tech companies connect with their target audience. The most successful fintech brands are those that adapt their marketing strategies to leverage these changes while maintaining a focus on building trust and delivering value.

In this comprehensive guide, I’ll break down the top five financial technology marketing strategies that are proving most effective in 2025. These aren’t just theoretical concepts – I’ll provide actionable insights on implementation, real-world examples, and specific tactics that can drive measurable results for your fintech business growth.

Whether you’re a fintech startup looking to establish your presence or an established finance tech company aiming to expand your market share, these financial technology marketing strategies will help you create more effective marketing campaigns, reach your target market, and ultimately convert more prospects into loyal customers.

Let’s dive into the five most powerful financial technology marketing strategies that should be central to your promotional activities this year.

Strategy 1: SEO – The Foundation of Fintech Marketing Success

Search engine optimization (SEO) stands as the cornerstone of effective financial technology marketing in 2025. With 90% of pages receiving no organic search traffic from Google, implementing a robust SEO for fintech strategy has become non-negotiable for fintech companies looking to increase their visibility and attract qualified prospects.

But the SEO landscape has evolved significantly, particularly for the fintech industry. Beyond traditional search engines like Google and Bing, we’re witnessing unprecedented growth in generative AI engines such as Search GPT, Perplexity, and Claude. These large language models (LLMs) are revolutionizing how people search for financial information and services, making specialized approaches essential to remain competitive.

Why SEO Matters More Than Ever for Fintech Companies

The shift toward conversational search through LLM models presents both challenges and opportunities for financial technology marketing. Unlike traditional search queries, users can now engage in dialogue-style interactions, asking complex questions about financial products or services in natural language. This fundamentally changes how fintech brands need to approach their content marketing strategies.

Additionally, even traditional search engines like Google are incorporating AI elements, with features like AI overviews and their recently released AI mode. These developments make technical SEO and structured content even more crucial for fintech businesses looking to maintain visibility across all search platforms.

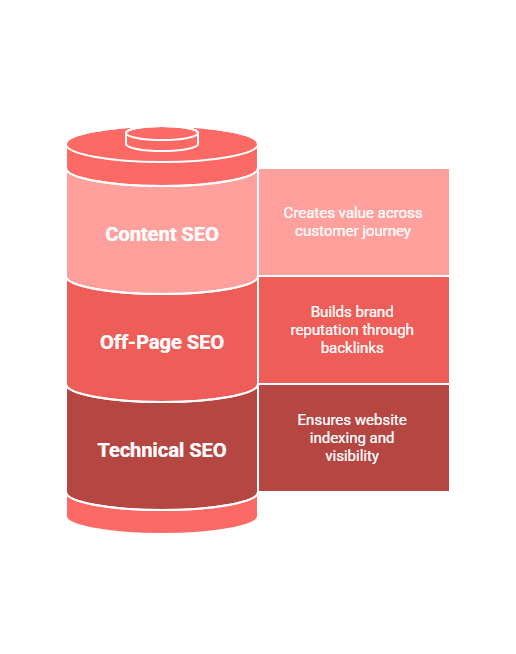

Three Pillars of Effective Fintech SEO

To create a comprehensive SEO strategy for your fintech business, focus on these three critical areas:

1. Technical SEO: Building a Solid Foundation

Technical SEO forms the backbone of your entire financial technology marketing strategy. It ensures your website is properly indexed and visible to search engines – a fundamental issue that explains why so many financial websites fail to generate organic traffic.

Key technical SEO elements for fintech websites include:

- Website architecture and indexing: Ensuring all important pages are discoverable and indexed by search engines

- Page speed optimization: Critical for user experience and search rankings, especially on mobile devices

- Mobile responsiveness: Essential as more users research financial services on smartphones

- Schema markup and structured data: Particularly important for fintech companies as it helps search engines understand complex financial content

Schema markup deserves special attention in the financial technology landscape. By implementing specific types of structured data, you provide search engines with context about your content. For example:

- Local business schema markup helps fintech companies with physical locations

- Article schema markup enhances visibility for educational financial content

- Video schema markup improves the performance of explainer videos about financial products

Notably, Microsoft has confirmed that schema markup helps content rank better within Copilot’s LLM model, making this technical element increasingly important for financial technology promotional activities across all search platforms.

2. Off-Page SEO: Building Authority in the Fintech Space

Off-page SEO focuses on building your fintech brand’s reputation and authority online. This primarily involves earning high-quality backlinks – links from other websites that point to your site.

For fintech companies, the quality of backlinks matters more than quantity. Links from reputable financial websites, industry publications, and trusted news sources signal to search engines that your brand is trustworthy and influential within the finance tech sector.

Strong off-page SEO signals make it significantly easier to rank for competitive fintech keywords. This is particularly important in the financial industry, where trust is paramount and search engines apply higher standards for what they call “Your Money or Your Life” (YMYL) content.

3. Content SEO: Creating Value Across the Marketing Funnel

Content remains king in financial technology marketing, but it must be strategically developed to address different stages of the customer journey:

- Top-of-funnel content: Educational articles about financial concepts, industry trends, and general information that attracts a broad audience interested in financial topics

- Middle-of-funnel content: More specific content that addresses particular pain points or questions potential customers have about financial services

- Bottom-of-funnel content: Highly targeted content that directly supports conversion, such as product comparisons, case studies, and detailed service information

Effective keyword research is essential for creating content that aligns with what your target audience is actually searching for. This requires understanding both the technical financial terms your prospects might use and the everyday language they employ when describing their financial needs or challenges.

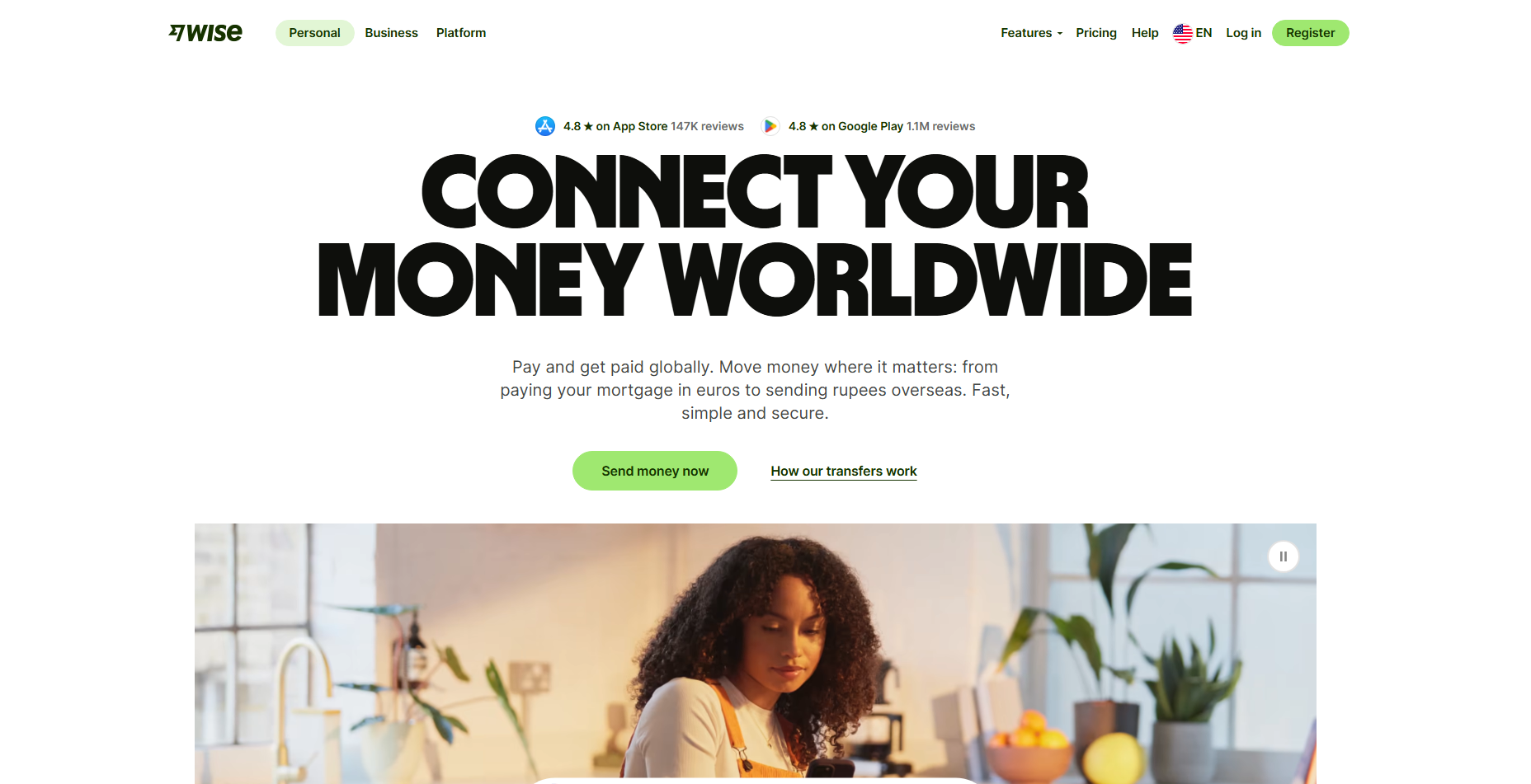

Real-World Example: Wise.com’s SEO Success

Wise.com (formerly TransferWise) provides an excellent case study of effective fintech SEO implementation. With an authority score of 94 (on a scale of 0-100) and approximately 201 million monthly organic searches, their SEO strategy demonstrates several key principles:

- High-authority backlink profile: Wise has systematically built relationships with reputable financial publications and websites.

- Comprehensive content strategy: Their content spans the entire marketing funnel, from educational articles about international banking to specific service pages for currency conversion.

- Strategic keyword targeting: They rank for high-value keywords like “YEN USD converter” that directly relate to their core services.

- Featured in AI overviews: For long-tail keywords like “how to open a bank account in USA for foreigners,” Wise appears prominently in AI-generated search results.

- Competitor keyword strategy: Interestingly, Wise creates content targeting competitor keywords (like PayPal-related terms) while strategically incorporating their own service offerings as alternatives.

How AI and LLMs Are Changing Fintech SEO

The rise of AI-powered search is particularly significant for financial technology marketing strategies. These systems often prioritize content differently than traditional search algorithms, with a stronger emphasis on:

- Content that demonstrates expertise and authority

- Information from trusted sources with strong backlink profiles

- Content that directly answers specific questions

- Structured data that helps AI systems understand complex financial concepts

For example, when users ask Claude (an AI assistant) about financial products or services, the results often highlight brands that have invested in comprehensive content strategies and built strong backlink profiles from relevant financial websites.

Herman Miller provides an instructive case study here. Their ergonomic chairs appear prominently in AI responses about posture-improving office furniture largely due to their strategic PR campaign that generated 273 high-quality backlinks with the anchor text “Herman Miller ergonomics.” This demonstrates how deliberate link-building strategies can influence visibility not just in traditional search but also in AI-powered recommendations.

Implementing SEO in Your Fintech Marketing Strategy

For fintech companies looking to enhance their SEO in 2025, consider these action steps:

- Conduct a technical SEO audit to identify indexing issues, page speed problems, and opportunities for schema markup implementation.

- Develop a strategic backlink acquisition plan focused on obtaining links from reputable financial websites and publications.

- Create a content calendar that addresses all stages of the marketing funnel, with special attention to the specific financial terms and questions your target audience is searching for.

- Monitor performance in both traditional search engines and AI-powered platforms to understand how your content performs across different search environments.

- Regularly update existing content to ensure it remains accurate, relevant, and optimized for the latest search algorithms and AI models.

By implementing these financial technology marketing strategies for SEO, you’ll build a solid foundation for your overall digital promotional activities, driving organic traffic that consists of qualified prospects actively seeking finance tech solutions.

Strategy 2: Reddit – The Underrated Fintech Marketing Goldmine

In 2025, Reddit has emerged as one of the most underrated yet powerful platforms for financial technology marketing. Recent data shows a significant increase in Reddit’s search visibility, with more financial discussions appearing prominently in search engine results pages (SERPs). This trend presents an exceptional opportunity for fintech companies to reach highly engaged prospects actively seeking finance tech solutions.

Why Reddit Is Gaining Traction in Fintech Marketing

Reddit’s growing importance in the financial technology marketing landscape stems from its recent partnership with Google, which has dramatically increased the visibility of Reddit threads in search results. When potential customers search for financial services or products, they’re increasingly likely to encounter relevant Reddit discussions near the top of their search results.

What makes this particularly valuable for financial technology promotional activities is the nature of these discussions. Unlike traditional marketing channels, Reddit provides access to authentic conversations where users are actively seeking recommendations, sharing experiences, and discussing financial pain points. This represents a goldmine of information about your target audience and a direct channel to reach qualified prospects.

Finding High-Performing Reddit Threads in the Fintech Space

The key to successful Reddit marketing for fintech companies lies in identifying threads that are already ranking well for relevant keywords. For example, a Reddit discussion about “what are good money transfer services” might receive over 1,000 organic visitors per month and rank for valuable bottom-of-funnel keywords like “best wire transfer services” or “best currency transfer service.”

These threads represent prime opportunities for fintech brands to get their services in front of users who are actively comparing options and making decisions. By analyzing the search performance of different Reddit threads, you can prioritize your participation in discussions that will deliver the highest return on your promotional activities.

Ethical Strategies for Reddit Marketing in the Fintech Industry

Reddit users are notoriously skeptical of overt marketing attempts, making it essential to approach this platform with authenticity and a value-first mindset. Effective Reddit marketing for fintech companies should focus on:

Value-First Commenting Approach

When participating in financial discussions, prioritize providing genuinely helpful information that addresses the specific questions or concerns raised in the thread. Your comments should demonstrate expertise and offer real value before mentioning your fintech services.

For example, if someone is asking about international money transfer options, you might explain the general factors to consider (exchange rates, fees, transfer speed) before briefly mentioning how your service addresses these concerns. This approach positions your brand as a helpful resource rather than an intrusive advertiser.

Building Authentic Presence

Successful financial technology marketing on Reddit requires building a consistent presence over time. This means:

- Regularly participating in relevant financial subreddits

- Establishing credibility through knowledgeable contributions

- Being transparent about your company affiliation when appropriate

- Engaging in two-way conversations rather than simply promoting your services

By becoming a recognized contributor in finance tech discussions, you’ll build trust with the Reddit community and increase the effectiveness of your promotional activities.

Advanced Reddit Marketing Tactics for Fintech Brands

For fintech companies looking to maximize their impact on Reddit, several more sophisticated strategies can be employed:

Strategic Upvote Approach

Comments with more upvotes receive greater visibility within Reddit threads, often appearing at the top when sorted by “Best” (the default sorting method). By ensuring your valuable contributions receive adequate upvotes, you can increase their visibility to users browsing high-ranking threads.

While Reddit has been cracking down on artificial engagement, there are legitimate ways to encourage upvotes:

- Creating exceptionally helpful, well-written responses that naturally attract positive engagement

- Timing your comments to appear early in trending discussions

- Encouraging team members to participate organically in conversations (while following Reddit’s terms of service)

Creating Original Posts Optimized for Search

Beyond commenting on existing threads, fintech companies can create their own posts designed to rank well in search results. This approach requires:

- Researching keywords that align with your fintech services

- Creating genuinely valuable discussion topics around these keywords

- Fostering active conversation within your posts

- Providing thoughtful responses to all comments

When executed well, this strategy can create long-lasting assets that continue to drive traffic and engagement for months or even years.

How Fintech Companies Are Leveraging Reddit

Several forward-thinking fintech brands have already incorporated Reddit into their marketing strategies with impressive results. One notable example involves a digital banking platform that identified a highly-ranked Reddit thread discussing alternatives to traditional banks.

By providing detailed, helpful information about the banking industry’s pain points and how modern fintech solutions address them, they were able to generate significant interest in their platform. Their comment received hundreds of upvotes, remained at the top of the thread for months, and ultimately drove thousands of qualified visitors to their website.

What made this approach successful was their focus on education rather than promotion. They explained the technology behind their banking solution, addressed common concerns about digital banking security, and only linked to their website in response to direct questions from interested users.

Implementing Reddit in Your Fintech Marketing Strategy

To effectively incorporate Reddit into your financial technology promotional activities:

- Research and identify high-performing threads related to your financial services

- Create a content strategy for Reddit that emphasizes value and education

- Establish guidelines for authentic engagement that complies with Reddit’s terms of service

- Monitor performance by tracking referral traffic and conversions from Reddit

- Adapt your approach based on community feedback and changing platform dynamics

When executed thoughtfully, Reddit marketing can become one of your most cost-effective channels for reaching engaged prospects in the financial technology landscape. The platform’s growing search visibility, combined with the high-intent nature of financial discussions, makes it an invaluable addition to your financial technology marketing strategies in 2025.

Strategy 3: Paid Advertising – Strategic Investment for Fintech Growth

Paid advertising remains a cornerstone of effective financial technology marketing strategies in 2025. Unlike SEO, which builds organic visibility over time, paid promotion allows fintech companies to immediately position themselves at the top of search results and across relevant digital platforms. Think of it as paying your way to visibility while you build longer-term marketing initiatives.

The Evolution of Paid Advertising in the Fintech Sector

The landscape of paid promotion for finance tech companies has transformed significantly in recent years. With increasing competition in the financial technology landscape, simply running generic ads is no longer sufficient. Today’s successful financial technology marketing campaigns require sophisticated targeting, compelling creative assets, and a deep understanding of the customer journey.

What’s particularly notable is how paid promotion now integrates with other promotional activities. The most effective fintech brands use paid channels to amplify their content marketing, support their social media strategy, and drive engagement with their community marketing initiatives.

Platform Selection for Fintech Advertising

Choosing the right platforms for your paid promotion is crucial for maximizing return on investment. For fintech companies, several channels have proven particularly effective:

Search Engine Marketing (SEM)

Google Ads and Bing Ads remain powerful platforms for capturing high-intent traffic. When potential customers search for financial services or products, appearing at the top of search results can significantly increase your chances of conversion.

For financial technology marketing, focus on:

- Keywords with clear commercial intent (e.g., “best investment apps,” “online banking services”)

- Long-tail keywords that indicate specific needs (e.g., “how to transfer money internationally without fees”)

- Competitor keywords to capture users comparing financial services

The advantage of SEM for fintech companies is the ability to reach users at the exact moment they’re actively seeking financial solutions. This makes it one of the highest-converting channels in your marketing arsenal.

Social Media Advertising

Different social platforms offer unique advantages for financial technology marketing:

- LinkedIn excels for B2B fintech services and products targeting financial professionals

- Facebook and Instagram provide sophisticated targeting for consumer financial products

- Twitter offers access to financially-engaged audiences and conversation around financial news

- TikTok has emerged as a surprisingly effective channel for reaching younger audiences with financial products

When creating social media ad campaigns for fintech, it’s essential to adapt your messaging to the platform’s context while maintaining compliance with financial advertising regulations.

Programmatic Advertising

Programmatic platforms allow fintech brands to place display and video ads across thousands of websites, targeting users based on their behavior, interests, and demographic profiles. This approach is particularly valuable for:

- Retargeting visitors who have shown interest in your financial services

- Building brand awareness among specific audience segments

- Reaching users on financial news sites and related content

Creating Effective Fintech Ad Campaigns

The success of your paid promotion depends heavily on the quality of your campaigns. For financial technology marketing, several elements deserve special attention:

Messaging That Addresses Financial Pain Points

Effective fintech ads directly address the specific challenges your target audience faces. Whether it’s high fees, complex processes, limited access, or poor customer service from traditional financial institutions, your messaging should clearly articulate how your fintech solution solves these problems.

For example, a money transfer service might highlight the pain points of traditional wire transfers (high fees, slow processing, lack of transparency) and then demonstrate how their technology eliminates these issues.

Compliance Considerations in Financial Advertising

The financial industry is heavily regulated, and these regulations extend to advertising. Your paid campaigns must navigate:

- Disclosure requirements for fees and rates

- Restrictions on claims about returns or performance

- Regulations regarding testimonials and endorsements

- Geographic restrictions on certain financial products

Working with legal experts who understand both financial regulations and advertising requirements is essential for financial technology promotional activities. Non-compliance can result in campaigns being rejected, accounts being suspended, or even regulatory penalties.

Budget Optimization and ROI Tracking

For fintech companies, optimizing advertising spend is particularly important given the often high cost-per-click in financial services categories.

Attribution Modeling

Implement sophisticated attribution models that account for the typically longer customer journey in financial services. Many fintech customers will interact with multiple marketing touchpoints before conversion, making it essential to understand the role each channel plays in the decision process.

Conversion Value Tracking

Beyond basic conversion tracking, assign accurate values to different types of conversions based on their likelihood to generate revenue. For example, a newsletter signup might be worth $5 in expected future value, while a product demo request might be worth $50.

A/B Testing Framework

Establish a rigorous testing framework for continuously improving campaign performance. Test different:

- Value propositions and messaging angles

- Creative formats and designs

- Landing page experiences

- Call-to-action approaches

Retargeting Strategies for Financial Services

Retargeting deserves special attention in financial technology marketing because of the consideration time typically involved in financial decisions. Effective retargeting strategies include:

- Sequential messaging that evolves as users move through the decision process

- Cross-channel retargeting that maintains consistent messaging across search, social, and display

- Time-based segmentation that adjusts messaging based on how recently users visited your site

- Behavior-based targeting that customizes ads based on specific pages or products viewed

Successful Fintech Paid Advertising Campaign

A digital investment platform provides an instructive example of effective paid promotion in the financial technology landscape. Facing intense competition, they implemented a multi-channel campaign with several key components:

- Search campaigns targeting both educational keywords (“how to start investing”) and product-specific terms (“best robo-advisor platforms”)

- YouTube pre-roll ads featuring short, engaging explanations of how their platform simplified investing

- Programmatic display focusing on financial news sites and retargeting site visitors

- Social campaigns highlighting customer testimonials and specific platform features

What made this campaign particularly effective was its integrated approach. Rather than treating each channel in isolation, they created a cohesive experience that guided prospects through the customer journey, from awareness to consideration to decision.

The campaign achieved a 43% lower cost-per-acquisition than previous efforts by focusing on:

- Precise audience targeting based on financial behaviors and interests

- Creative that directly addressed common investing pain points

- Landing pages optimized for each traffic source and user intent

- Continuous testing and optimization of all campaign elements

Implementing Paid Advertising in Your Fintech Marketing Strategy

To maximize the effectiveness of sponsored content for your fintech business:

- Define clear campaign objectives that align with your overall business goals

- Develop a multi-channel strategy that leverages the strengths of different platforms

- Create compelling, compliant creative assets that address specific financial pain points

- Implement robust tracking to measure performance across the customer journey

- Continuously test and optimize to improve return on ad spend

When executed strategically, sponsored content can be one of your most scalable and measurable digital finance marketing strategies, driving qualified traffic while you build longer-term organic visibility.

Strategy 4: Email Marketing – Building Customer Relationships in Fintech

Email marketing remains one of the most powerful and direct channels in any comprehensive financial technology marketing strategy. In an industry where trust and ongoing relationships are paramount, email provides an unparalleled opportunity to nurture prospects, educate customers, and drive conversions through personalized communication.

Why Email Marketing Is Crucial for Fintech Companies

Despite the rise of newer marketing channels, email continues to deliver exceptional ROI for fintech businesses for several key reasons:

- Direct access to your audience: Unlike social media or search, where algorithms determine visibility, email gives you a direct line to your prospects and customers

- Ownership of the channel: Your email list is a business asset you control, unlike followers on third-party platforms

- High engagement potential: Financial information is inherently personal, making email’s private nature ideal for discussing sensitive topics

- Sophisticated segmentation capabilities: Modern email platforms allow for highly targeted messaging based on user behavior and preferences

- Measurable results: Email provides clear metrics on engagement, conversion, and ROI

For fintech companies specifically, email marketing serves as a critical tool for building financial literacy, explaining complex products, and guiding users through multi-step processes that often characterize financial services.

Building and Segmenting Fintech Email Lists

The foundation of effective email marketing is a quality list of engaged subscribers. For financial technology marketing, focus on:

Value-Driven List Building

Rather than generic “subscribe to our newsletter” calls-to-action, offer specific value that addresses financial pain points:

- Free financial assessment tools

- Educational guides on relevant financial topics

- Access to exclusive market insights or research

- Calculators or interactive tools that help solve financial problems

These lead magnets not only increase conversion rates but also immediately demonstrate the value your fintech brand provides.

Strategic Segmentation

Segmentation is particularly important in financial technology marketing due to the diverse needs and situations of your audience. Consider segmenting based on:

- Financial goals: Saving, investing, borrowing, transferring money, etc.

- Knowledge level: Financial novices vs. sophisticated users

- Product interest: Specific services or features they’ve explored

- Behavioral signals: Website pages visited, tools used, or resources downloaded

- Customer lifecycle stage: Prospect, new user, established customer, power user

Effective segmentation allows you to deliver highly relevant content that addresses the specific financial concerns of different audience groups, significantly improving engagement and conversion rates.

Creating High-Converting Email Sequences for Financial Products

The complexity of many fintech products makes strategic email sequences particularly valuable. These automated journeys guide prospects through the consideration process and help customers maximize value from your services.

Educational Content for Financial Literacy

Many potential customers may not fully understand the financial concepts behind your products. Educational email sequences can:

- Break down complex financial topics into digestible pieces

- Address common misconceptions about financial services

- Highlight the benefits of modern fintech approaches versus traditional methods

- Build credibility by demonstrating your expertise in the financial space

This educational approach positions your brand as a trusted advisor rather than just another financial service provider.

Promotional Offers That Drive Conversion

When moving from education to promotion, fintech companies should focus on:

- Clearly articulating the specific problem your product solves

- Demonstrating the unique advantages of your technology

- Addressing common objections or concerns about adoption

- Providing social proof through case studies or testimonials

- Creating urgency through limited-time offers or exclusive benefits

The most effective promotional emails in financial technology marketing combine emotional appeals (freedom from financial stress, confidence in financial decisions) with rational benefits (time savings, cost reduction, improved returns).

Personalization and Automation in Fintech Email Marketing

The finance tech sector is uniquely positioned to leverage advanced personalization due to the data-rich nature of financial services.

Behavioral Triggers

Set up automated emails triggered by specific user actions:

- Abandoned application follow-ups

- Onboarding sequences after sign-up

- Feature adoption encouragement for underutilized services

- Re-engagement campaigns for dormant accounts

- Milestone celebrations (account anniversary, savings goals reached)

These behavior-based emails deliver relevant content at the perfect moment, significantly increasing engagement and conversion rates.

Dynamic Content Personalization

Beyond basic personalization like using the recipient’s name, implement dynamic content blocks that change based on user data:

- Product recommendations based on financial profile

- Content tailored to specific financial goals

- Customized tips based on account usage patterns

- Localized information for regional financial considerations

This level of personalization demonstrates that you understand each customer’s unique financial situation and needs.

Compliance Considerations in Fintech Email Marketing

Financial services face stricter regulatory requirements than many other industries. Your email marketing must navigate:

- GDPR, CAN-SPAM, and other privacy regulations: Ensuring proper consent and providing easy unsubscribe options

- Financial advertising rules: Including necessary disclaimers and avoiding prohibited claims

- Data security requirements: Protecting sensitive financial information in your email operations

- Record-keeping obligations: Maintaining documentation of marketing communications as required by financial regulators

Working with both marketing and legal teams to develop compliant templates and approval processes can streamline your email marketing while ensuring regulatory adherence.

Measuring Email Marketing Success in the Fintech Space

Beyond standard email metrics like open and click rates, fintech companies should focus on:

- Conversion to product adoption: How effectively emails drive actual service usage

- Customer lifetime value impact: How email engagement correlates with long-term value

- Cross-selling success: Effectiveness in expanding customers’ product portfolio

- Retention and churn reduction: Impact of email programs on customer loyalty

- Financial education effectiveness: Improved financial literacy and confidence among subscribers

These metrics help quantify the full business impact of your email promotional activities beyond immediate response rates.

Email Marketing Campaign That Drove Fintech Business Growth

A personal finance management app provides an excellent example of effective email marketing in the financial technology landscape. Facing challenges with user activation and engagement, they implemented a comprehensive email strategy with several key components:

- Personalized onboarding sequence based on the financial goals selected during signup

- Weekly financial insights drawing on users’ own transaction data to provide personalized value

- Feature spotlight emails highlighting underutilized tools relevant to each user’s situation

- Milestone celebration messages recognizing progress toward financial goals

- Re-engagement campaigns for dormant users with personalized incentives to return

The results were impressive:

- 64% increase in feature adoption among new users

- 42% reduction in 30-day churn rate

- 28% improvement in premium conversion rate

- 3.2x higher average session frequency among email-engaged users

What made this campaign particularly effective was its focus on delivering genuine value in every communication. Rather than simply promoting features, each email provided actionable financial insights that helped users improve their financial health.

Implementing Email Marketing in Your Fintech Strategy

To maximize the effectiveness of email in your financial technology promotional activities:

- Invest in quality list building with valuable financial resources and tools

- Develop strategic segmentation based on financial needs and behaviors

- Create automated journeys that guide users through the customer lifecycle

- Implement advanced personalization leveraging financial data (within compliance boundaries)

- Establish clear measurement frameworks that connect email engagement to business outcomes

When executed thoughtfully, email marketing becomes not just a promotional channel but a valuable financial resource for your customers—building loyalty, driving engagement, and ultimately supporting business growth for your fintech company.

Strategy 5: Influencer Marketing – Leveraging Trust in Financial Services

In the highly regulated and trust-dependent fintech industry, creator partnerships has emerged as a powerful strategy for building credibility and reaching new audiences. Unlike traditional advertising, influencer partnerships leverage established relationships between content creators and their followers, creating authentic endorsements that resonate deeply with potential customers.

The Unique Role of Influencers in the Fintech Industry

Influencer marketing in the financial technology landscape differs significantly from other industries. While fashion or lifestyle brands might focus on aspirational content, fintech creator partnerships centers on expertise, education, and trust. This distinction is crucial for finance tech companies developing their marketing strategies.

The most effective financial technology promotional activities with influencers focus on:

- Explaining complex financial concepts in accessible ways

- Demonstrating how technology simplifies financial processes

- Building trust through transparent discussions of benefits and limitations

- Showcasing real-world applications and results

This approach aligns perfectly with the needs of fintech companies, where customer acquisition often hinges on overcoming skepticism about new financial technologies or approaches.

Types of Influencers for Fintech Marketing

Not all influencers are equally effective for fintech brands. The most valuable partnerships typically fall into these categories:

Financial Experts and Thought Leaders

These influencers include financial advisors, economists, business journalists, and industry veterans who have established credibility through their professional expertise. They typically have:

- Deep knowledge of financial concepts and regulations

- Established credibility with financially-savvy audiences

- Smaller but highly engaged followings

- Strong presence on platforms like LinkedIn and Twitter

Partnerships with these influencers lend significant authority to your fintech brand and can be particularly effective for reaching sophisticated users or B2B audiences.

Finance Content Creators

A growing category of influencers focuses specifically on financial education and advice across platforms like YouTube, TikTok, and Instagram. These creators have built audiences specifically interested in:

- Personal finance management

- Investment strategies

- Financial independence

- Money-saving techniques

- Financial technology tools

These influencers excel at translating complex financial concepts into engaging, accessible content that resonates with everyday consumers. Their audiences typically consist of people actively looking to improve their financial literacy and adopt new financial tools.

Customer Advocates

Sometimes your most powerful influencers are your own satisfied customers who have a platform or following. These might include:

- Entrepreneurs who use your financial tools to run their businesses

- Individual investors who have achieved success with your platform

- Financial coaches who recommend your services to their clients

The authenticity of these endorsements makes them particularly powerful for financial technology marketing, as prospective customers can see real-world applications and results.

Finding and Vetting the Right Influencers for Your Fintech Brand

The sensitive nature of financial services makes proper influencer selection crucial. When identifying potential partners, consider:

Alignment with Financial Values

Look beyond follower counts to evaluate whether an influencer’s content and values align with your fintech brand’s approach to financial management. Do they promote responsible financial practices? Do they provide balanced information? Are they transparent about risks and limitations?

Audience Relevance

Analyze the influencer’s audience demographics and engagement patterns. Are they reaching your target market? Do their followers actively engage with financial content? Are they attracting users with genuine interest in finance tech?

Compliance History

Review the influencer’s previous branded content, particularly with other financial services. Do they understand disclosure requirements? Have they maintained compliance with financial advertising regulations? Have they been involved in any controversial promotions?

Content Quality and Consistency

Evaluate the educational value and accuracy of their financial content. Do they explain concepts clearly? Is their information factually correct? Do they maintain a consistent publishing schedule and engagement with their audience?

Creating Effective Influencer Partnerships

Once you’ve identified appropriate influencers, focus on developing partnerships that deliver value to all parties—your brand, the influencer, and their audience.

Content Collaboration Ideas

The most effective fintech influencer campaigns typically include:

- Educational series explaining financial concepts related to your services

- Behind-the-scenes looks at how your technology works and the problems it solves

- Comparison content highlighting your advantages over traditional financial services

- Challenge or case study content documenting real results from using your platform

- Q&A sessions addressing common questions or concerns about your financial services

These formats allow influencers to maintain their authentic voice while effectively communicating your value proposition.

Compliance Considerations

Financial creator partnerships requires careful attention to regulatory requirements:

- Ensure all endorsements include proper disclosures (#ad, #sponsored, etc.)

- Provide clear guidelines about claims that can and cannot be made

- Review content before publication to ensure compliance

- Document all influencer agreements and communications

- Monitor published content for ongoing compliance

Many fintech companies develop specialized influencer briefing documents that outline both marketing objectives and compliance requirements to streamline this process.

Measuring Influencer Marketing ROI in Fintech

Determining the effectiveness of influencer partnerships requires looking beyond basic metrics like impressions or engagement. For financial technology marketing, focus on:

- Attributed sign-ups or conversions using unique tracking links or promo codes

- Brand search volume increases during and after campaigns

- Sentiment analysis of comments and responses to sponsored content

- Content engagement metrics compared to your owned media performance

- Customer acquisition cost relative to other marketing channels

These measurements help quantify the business impact of your creator partnerships efforts and inform future partnership decisions.

How Influencer Marketing Built Brand Awareness for a Fintech Startup

A mobile investing app targeting first-time investors provides an excellent example of effective influencer collaborations in the financial technology landscape. Facing challenges with trust and awareness among their target demographic of young professionals, they implemented a multi-tiered influencer strategy:

- Micro-influencer campaign with 25+ financial content creators producing educational content about investing basics and highlighting how the app removed traditional barriers

- Financial expert partnerships with certified financial planners who provided more technical analysis of the platform’s approach and benefits

- Customer success stories featuring real users who had achieved specific financial goals using the app

The campaign results demonstrated the power of this approach:

- 127% increase in brand search volume during the campaign period

- 43% lower customer acquisition cost compared to their paid social campaigns

- 86% positive sentiment in comment analysis across all influencer content

- 31% of new users during the campaign period came through influencer tracking links

What made this campaign particularly effective was its layered approach—using different types of influencers to address various aspects of the customer journey, from basic education and awareness to technical validation and social proof.

Implementing Influencer Marketing in Your Fintech Strategy

To maximize the effectiveness of influencer collaborations for your fintech business:

- Identify influencers whose audiences and values align with your target market

- Develop clear briefing materials that balance marketing objectives with compliance requirements

- Focus on educational content that provides genuine value while highlighting your solutions

- Establish robust tracking mechanisms to measure business impact

- Build long-term relationships with high-performing influencers rather than one-off campaigns

When executed thoughtfully, influencer collaborations can help fintech companies overcome one of their biggest challenges—building trust and credibility in an industry where customers are understandably cautious about new players and approaches.

Conclusion: Implementing an Integrated Fintech Marketing Strategy

As we’ve explored throughout this guide, effective financial technology marketing in 2025 requires a multi-faceted approach that combines technical expertise, authentic engagement, and strategic content development. Each of the five financial technology marketing strategies we’ve discussed offers unique advantages and opportunities for finance tech companies looking to grow their market presence and attract qualified prospects.

The Power of an Integrated Approach

While each strategy can deliver results independently, the most successful fintech companies implement an integrated marketing approach where these strategies reinforce and amplify each other:

- SEO builds a foundation of organic visibility and establishes your expertise in the financial technology landscape

- Reddit marketing taps into authentic conversations and provides direct access to engaged prospects

- Paid advertising delivers immediate visibility and allows precise targeting of high-value segments

- Email marketing nurtures relationships and guides prospects through complex financial decisions

- Influencer marketing leverages trusted voices to build credibility and reach new audiences

By coordinating these financial technology marketing strategies, you create multiple touchpoints throughout the customer journey, reinforcing your message and building trust at each stage of the decision process.

Future Trends in Fintech Marketing to Watch

As you implement these strategies, keep an eye on emerging trends that will shape financial technology marketing in the coming years:

- AI-powered personalization will continue to evolve, allowing for increasingly sophisticated targeting and customization of financial content and offers.

- Voice search optimization will become more important as consumers increasingly use voice assistants to find financial information and services.

- Augmented reality experiences will create new opportunities for demonstrating complex financial products and visualizing financial outcomes.

- Community-based marketing will grow in importance as consumers seek trusted spaces to discuss financial decisions and compare experiences.

- Privacy-first marketing approaches will become essential as regulations tighten and consumers become more protective of their financial data.

Staying ahead of these trends while mastering the core strategies we’ve discussed will position your fintech brand for sustainable growth in an increasingly competitive landscape.

Taking Action: Next Steps for Your Fintech Marketing Strategy

To implement the financial technology marketing strategies outlined in this guide:

- Assess your current promotional activities against each of the five strategies to identify gaps and opportunities.

- Prioritize initiatives based on your specific business goals, target audience, and available resources.

- Develop an integrated marketing calendar that coordinates activities across all channels.

- Establish clear metrics for measuring the performance of each strategy and your overall promotional activities.

- Continuously test and optimize your approach based on data and changing market conditions.

Remember that effective financial technology marketing is not about implementing the latest trend or technology—it’s about consistently delivering value to your target audience, building trust in your financial solutions, and clearly communicating how your technology solves real financial problems.

By thoughtfully implementing the five financial technology marketing strategies we’ve explored—SEO, Reddit marketing, paid promotion, email marketing, and creator partnerships—you’ll create a robust foundation for sustainable growth in the dynamic and competitive fintech industry.

Implementing these digital finance marketing strategies requires a holistic approach. Many fintech companies are now focusing on social media marketing across various social media platforms to build customer engagement. Creating valuable content and high quality content is essential for fintech content marketing success. Digital promotional activities should include a customer centric approach that prioritizes amazing customer service and fosters customer loyalty. Fintech startups and established fintech firms alike can benefit from collaboration marketing and experiential marketing initiatives. Traditional media still has its place alongside social media in a comprehensive strategy. Financial institutions are evolving their approach to meet changing customer needs, while digital finance marketing agencies help guide companies through their financial journey. Strong brand identity helps fintech apps stand out in the crowded marketplace. Marketing teams must focus on strategies to increase user engagement, reward customers, and convert prospects into new customers and existing customers into advocates. Video content continues to be an effective way to educate customers about complex offerings.

The finance tech companies that will thrive in 2025 and beyond are those that combine innovative products with equally innovative marketing approaches. By investing in these proven digital finance marketing strategies, you’re positioning your business to connect with the right prospects, build meaningful relationships, and ultimately drive the growth and impact you seek in the finance tech space.

Need help implementing an SEO strategy for your Fintech business? I offer free video SEO audits for your website, providing personalized insights to improve your SEO strategy and drive more conversions. Partner with an experienced freelance SEO consultant today!