Finding the right fintech SEO agency feels like navigating a minefield. You need someone who gets compliance, understands complex buyer journeys, and can actually drive qualified leads, not just vanity traffic.

Here’s the reality: fintech SEO delivers an average 1,031% ROI when done right, with results visible in about nine months. But most agencies either lack the regulatory knowledge to avoid compliance disasters or they’re so generic that your $500M funding round announcement gets the same strategy as a local pizza shop.

I’ve spent years optimizing for fintech brands, SaaS companies, and enterprise clients navigating the exact challenges you’re facing. I’ve watched AI completely reshape how financial content gets discovered, and I’ve tested every emerging platform from ChatGPT to Perplexity to understand what actually works.

This list ranks seven agencies that genuinely specialize in fintech SEO, not just agencies that added “fintech” to their services page last month. I ranked myself first because I offer something fundamentally different: direct access to the strategist doing the work, AI-first methodology that competitors are still figuring out, and zero agency overhead inflating your costs.

But I’ve also included six other solid options depending on your specific needs, budget, and growth stage. Some excel at enterprise-scale technical optimization. Others dominate content-driven strategies. A few bring proprietary tech that delivers measurable results.

Let’s cut through the noise and find your best fit.

1. Ricardo Rodriguez

I’m leading this list for three specific reasons.

First, I specialize in the exact intersection where fintech SEO is heading: AI-driven discovery, generative engine optimization, and LLM visibility. While most agencies are still figuring out how ChatGPT citations work, I’ve spent the last 18 months testing, measuring, and refining strategies that get fintech brands cited in AI-generated answers. When someone asks Claude about the best payment processors or ChatGPT about cryptocurrency tax software, your brand needs to be in that response. I make that happen through structured data implementation, entity relationship optimization, and content formats that machines can parse and trust.

Second, you work directly with me, not a junior account manager reading from a playbook. When you hire an agency, you’re paying for layers of overhead, internal meetings, and people who’ve never actually done the work. When you hire me, you get someone who’s spent a decade in the trenches doing technical SEO, building content strategies, and actually moving the needle for B2B SaaS and fintech brands. I’ve retained clients for 3-5 years because they see measurable revenue impact, not because they’re locked into contracts. My approach combines deep technical audits with conversion-focused content strategy, ensuring we’re driving qualified leads that actually close, not just traffic that bounces.

Third, I bring capabilities most agencies don’t even know exist yet. Reddit marketing integration for AI visibility, since Reddit conversations now train the LLMs that recommend brands. Programmatic SEO for fintech companies managing hundreds of location pages or product variations. International SEO that goes beyond translation to actual market-specific keyword research and cultural adaptation. And conversion rate optimization that turns your organic traffic into pipeline, not just a vanity metric you report to investors.

My typical fintech clients are growth-stage companies post-Series A who need sustainable organic channels but can’t justify $50K monthly agency retainers. They’re tired of agencies that deliver beautiful reports with zero business impact. They want someone who understands that a compliance-heavy industry requires different tactics than e-commerce, and they value the ability to text me with urgent questions instead of submitting tickets into an agency queue.

If you want AI-first SEO strategy that actually positions your fintech brand for how search is evolving, if you value direct access over account management layers, and if you need someone who can execute technical implementations instead of just making recommendations, let’s talk. I take on limited clients specifically so I can deliver the hands-on attention that moves metrics.

2. First Page Sage

First Page Sage has carved out serious authority in the B2B SaaS and fintech space since 2009, and they’ve done it by staying ahead of trends most agencies ignore until they’re mainstream. They pioneered generative engine optimization methodology before most competitors even understood what it meant, and they’ve published extensively on how AI recommendation algorithms actually function.

Their founder-led approach means you’re getting strategic direction from people who’ve spent 15+ years doing this work, not fresh marketing grads following templates. They’ve worked with heavyweight clients like Salesforce, Microsoft, and SoFi, brands that don’t tolerate mediocre results or vague reporting. Their case studies show detailed implementation processes, not just before-and-after traffic screenshots, which tells you they’re confident in their methodology.

What makes First Page Sage particularly valuable for fintech brands is their emphasis on new conversions and rank-ordered keyword prioritization. They’re not optimizing for keywords that drive traffic but never convert. They’re reverse-engineering your ideal customer profile and targeting the exact search queries those prospects use when they’re ready to evaluate solutions. Their GEO strategies ensure your content gets cited in AI-generated answers, which matters as more financial decision-makers start research conversations with ChatGPT instead of Google.

The trade-off is pricing, they’re a premium option best suited for well-funded fintech companies with $10K+ monthly budgets. Their 4.9/5 Clutch rating across verified reviews suggests clients feel the investment delivers returns, but this isn’t the agency for bootstrapped startups watching every dollar.

3. Silverback Strategies

Silverback Strategies has spent 18 years becoming the go-to agency for financial services institutions that need compliance expertise baked into every SEO decision. They’re based in Washington DC, which tells you something about their client base. Heavily regulated financial brands, government-adjacent fintech companies, and institutions where one compliance mistake could mean regulatory scrutiny.

Their approach combines technical SEO excellence with advanced analytics specifically tailored to financial services, and they’ve documented 442% ROI over three years for fintech clients according to Forrester research. That’s not traffic growth, that’s actual business impact measured in revenue attribution. They understand GDPR, CCPA, and the regulatory frameworks that make financial marketing feel like walking through a compliance minefield while blindfolded.

What sets Silverback apart is their focus on lowering customer acquisition costs while maintaining regulatory compliance. Most agencies can do one or the other. Silverback does both by understanding that fintech SEO isn’t just about rankings. It’s about building trust signals that both search engines and regulators recognize as authoritative. They implement schema markup that helps search engines understand your entity relationships without triggering compliance red flags. They build content strategies that establish expertise without making claims that could attract regulatory attention.

Their client roster skews toward established financial institutions and later-stage fintech companies rather than early startups, and their pricing reflects that positioning. If you’re navigating complex regulatory requirements and need an agency that won’t accidentally get you in trouble while chasing rankings, Silverback brings peace of mind alongside performance.

4. Directive Consulting

Directive Consulting has built their entire business model around B2B SaaS SEO with a customer generation methodology that prioritizes revenue over vanity metrics. Founded in 2014, they’ve refined an approach that integrates CRM data, share of SERP modeling, and AI-informed strategies to focus exclusively on keywords that actually generate pipeline.

Their differentiation comes from treating SEO as a revenue channel, not a traffic channel. They’re measuring qualified leads, opportunity creation, and closed revenue. The metrics your CFO actually cares about when evaluating marketing spend. Their share of SERP methodology helps fintech brands understand not just whether they’re ranking, but whether they’re capturing meaningful visibility against competitors in the specific queries that drive customer decisions.

Directive works particularly well for growth-stage fintech companies with defined sales processes and CRM infrastructure. If you can’t track a lead from organic search through opportunity creation to closed revenue, their methodology loses some power. But if you’ve got marketing attribution dialed in and you need an agency that speaks the language of pipeline contribution rather than keyword rankings, Directive brings serious capability.

They’ve worked with recognizable B2B SaaS brands and fintech companies, and their case studies focus on metrics like MQL generation, sales qualified opportunities, and customer acquisition cost reduction. The team understands that fintech sales cycles are long, complex, and multi-touch, which means SEO strategies need to support prospects across multiple research stages rather than optimizing for quick conversions.

Their pricing sits in the premium range, typically starting around $10K monthly for comprehensive programs, and they prefer longer-term partnerships where they can influence broader go-to-market strategy beyond just SEO tactics.

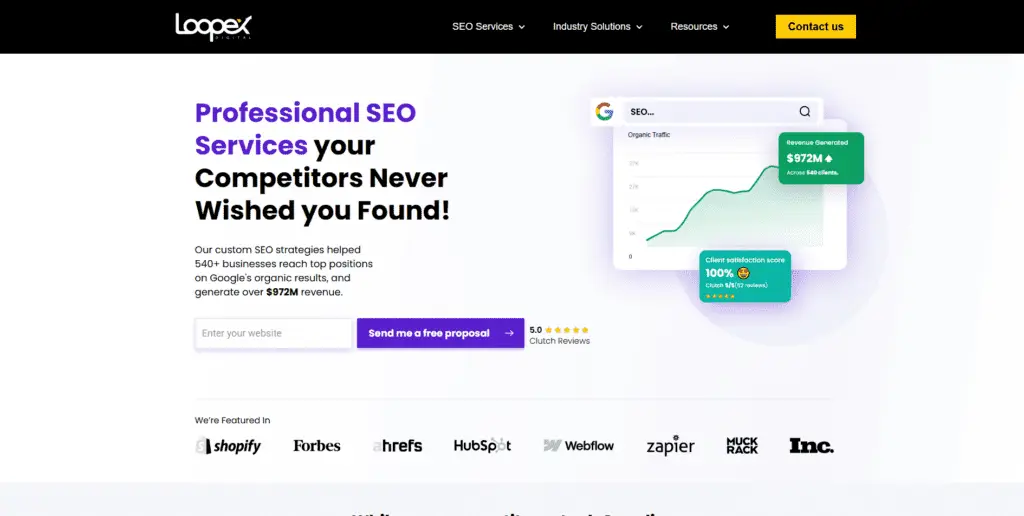

5. Loopex Digital

Loopex Digital stands out for innovative AI integration in technical SEO optimization, and their results speak louder than most agency marketing. They documented a 1,839% organic traffic increase in under two years for a fintech client, creating over $1 million in documented business opportunities. That’s not a typo, they nearly 20x’d organic traffic while maintaining quality that converted.

Their approach leverages AI technologies to improve site speed, technical structure, and crawlability. The foundational elements that determine whether your content even gets indexed properly before you worry about rankings. They’ve built proprietary processes for technical audits that identify issues most agencies miss, and their implementation focus means they’re not just handing you recommendations and hoping you have dev resources to execute.

What makes Loopex particularly valuable for fintech companies is their understanding that financial websites often suffer from bloated tech stacks, compliance-required elements that slow page speed, and complex site architectures that confuse search engine crawlers. They optimize within those constraints rather than recommending you rebuild from scratch, a practical approach for companies with legacy systems and regulatory requirements limiting how much you can change.

Their 5/5 Clutch rating across 53 verified reviews establishes them as consistently delivering results, and their specialization in B2B SaaS and fintech means they understand your competitive landscape and buyer journey complexity. The trade-off is availability, they’re selective about client engagements, which means you might wait for capacity. But that selectivity is exactly why they maintain quality and results consistency.

6. Victorious

Victorious brings 12 years of experience and a data-driven methodology focused on transparency and scalability, headquartered in San Francisco with strong connections to the fintech and SaaS communities that dominate that market. They’ve built particular expertise in technical site audits, keyword research that prioritizes business objectives, and performance tracking with measurable strategies aligned to your actual goals.

Their approach emphasizes sustainable, long-term visibility rather than quick wins that collapse when algorithm updates hit. They’ve received specific recognition for work with financial services companies, and their 4.8/5 rating in financial services rankings demonstrates consistent delivery within this specialized vertical. They understand that fintech SEO requires different tactics than e-commerce because purchase decisions involve higher stakes, longer consideration periods, and more stakeholders.

Victorious works well for mid-market to enterprise fintech companies that need scalable processes but still want strategic customization. They’re large enough to have specialized teams for technical SEO, content strategy, and link building, but not so massive that you’re getting cookie-cutter approaches. Their reporting focuses on business impact metrics rather than just ranking movements, which creates accountability for actual performance.

The agency handles both traditional SEO fundamentals and emerging priorities like voice search optimization and schema implementation, recognizing that fintech brands need to maintain current performance while positioning for platform evolution. Their client roster includes recognizable brands, and their case studies document specific tactics and timelines rather than just celebrating results without context.

7. iPullRank

iPullRank positions itself as an enterprise-focused SEO and content strategy agency with particular strength helping fintech companies adapt to both traditional search and AI-driven discovery. They emphasize user intent analysis, data structure implementation, and understanding how financial content gets interpreted by modern large language models, capabilities that matter as search evolves beyond keyword matching.

Their services encompass AI SEO optimization and thought leadership content creation, providing comprehensive support for the complex buyer journeys that characterize fintech decision processes. They understand that someone researching payment processors or investment platforms isn’t making impulse decisions, they’re conducting extensive research, comparing multiple options, and seeking validation from trusted sources. iPullRank builds content ecosystems that support prospects through that entire journey.

What differentiates iPullRank is their technical sophistication combined with strategic content thinking. They’re not just implementing schema markup, they’re architecting data structures that help both traditional search engines and AI systems understand your entity relationships, topical authority, and trustworthiness signals. They’re creating content that establishes genuine expertise rather than keyword-stuffed blog posts that insult your audience’s intelligence.

Their client focus skews toward larger fintech companies and financial services institutions with substantial content needs and complex regulatory environments. They’re comfortable navigating YMYL (Your Money or Your Life) content requirements, understanding that financial advice and product recommendations require higher standards of accuracy, sourcing, and expertise demonstration than most industries.

The agency’s pricing reflects their enterprise positioning, and they typically work best with companies ready to invest meaningfully in content programs that compound value over time rather than businesses seeking quick traffic fixes.

Finding Your Fintech SEO Partner

Choosing a fintech SEO agency comes down to three critical factors: specialized expertise in financial services and regulatory compliance, proven results driving qualified leads rather than just traffic, and methodology that addresses both current search platforms and AI-driven discovery evolution.

The agencies on this list bring genuine fintech specialization, not generic SEO repackaged with industry buzzwords. They understand that complex buyer journeys, regulatory constraints, and trust requirements make fintech optimization fundamentally different from e-commerce or local services.

If you’re a growth-stage fintech company that needs direct access to strategic expertise without agency overhead, AI-first methodology that positions you for search evolution, and conversion-focused optimization driving actual pipeline, I’d love to discuss your specific situation.

The fintech SEO market delivers exceptional returns when you partner with specialists who understand your unique challenges. Don’t settle for agencies treating your $500M funding round announcement with the same strategy they use for everyone else.

Frequently Asked Questions

What makes fintech SEO different from regular SEO?

Fintech SEO operates in a regulated environment where Your Money or Your Life content standards apply, meaning Google scrutinizes financial content more carefully for accuracy, expertise, and trustworthiness. You’re also dealing with complex buyer journeys where prospects research extensively before making decisions, requiring content that supports multiple buying stages rather than just transactional keywords. Compliance requirements limit certain marketing tactics, and the competitive intensity in financial keywords means you need sophisticated strategies to break through.

How much does fintech SEO typically cost?

Most specialized fintech SEO agencies charge between $5,000-$20,000 monthly for comprehensive programs, with enterprise-level services reaching $50,000+ annually for multinational implementations. Smaller agencies and independent consultants might start around $3,000-$5,000 monthly for focused programs. The investment level depends on your competitive landscape, content needs, technical complexity, and whether you need additional services like conversion optimization or international SEO. Quality fintech SEO requires specialized expertise, so extreme budget options often deliver poor results.

How long does it take to see results from fintech SEO?

Expect initial traction within 3-4 months with measurable ranking improvements and traffic growth around the 6-9 month mark for most fintech SEO programs. The average time to break even on investment sits around nine months, with compounding returns afterward. Fintech SEO timelines run longer than some industries because you’re building trust signals and topical authority in competitive spaces where Google applies stricter evaluation criteria. Technical fixes might show faster impact, while content-driven strategies require more patience but deliver sustainable long-term results.

Should fintech companies focus on traditional SEO or generative engine optimization?

You need both. Traditional Google search still drives the majority of organic traffic and qualified leads for most fintech companies, so neglecting foundational SEO would be strategic malpractice. But generative engine optimization is critical for future-proofing as more prospects start product research with ChatGPT, Claude, or Perplexity instead of Google. The good news is that GEO and traditional SEO share foundations, structured data, topical authority, clear content, and trustworthy sources benefit both. Agencies offering integrated approaches deliver better long-term value than those ignoring AI evolution.

What SEO metrics matter most for fintech companies?

Focus on qualified organic traffic, conversion rates from organic channels, keyword rankings for high-intent buyer terms, and ultimately revenue attribution from organic search. Vanity metrics like total traffic or keyword rankings for informational queries matter less than whether SEO drives prospects who actually convert to customers. Track organic-attributed MQLs, sales qualified opportunities from organic channels, customer acquisition cost for organic versus paid channels, and customer lifetime value by acquisition source. If your agency reports rankings without business impact, you’re measuring the wrong things.

How do I evaluate if a fintech SEO agency understands compliance?

Ask specific questions about YMYL content standards, how they approach regulatory constraints in financial marketing, and whether they’ve worked with companies in your regulatory environment. Request case studies demonstrating compliance-friendly optimization, and ask how they balance performance with risk mitigation. Agencies with genuine fintech experience will discuss schema implementation for financial products, content review processes ensuring accuracy, and how they navigate claims that could trigger regulatory scrutiny. If they treat fintech like any other vertical, they’ll eventually create compliance headaches.

Can fintech startups afford quality SEO services?

Yes, but you need realistic expectations about scope. Early-stage fintech companies might start with focused technical audits and foundational optimization in the $3,000-$5,000 monthly range through specialized consultants or smaller agencies. This establishes proper site architecture, implements essential schema, and creates content foundations you can build on. As you secure funding and grow, you can expand into comprehensive content programs, link building, and international optimization. Starting early with quality fundamentals costs less than fixing technical debt and poor content later when you’re trying to scale.